Budget 2022 did not provide for any change in the standard deduction amount available to employees

and retirees. Therefore, This will effectively mean that salaried individuals and retirees (whose pension is taxed)

In other words,

However, Below the head salary) will continue to claim the same standard deduction amount in fiscal 2022-23 as they did in fiscal 2021-22. For instance, can claim Rs 50,000 as a standard deduction if they opt for the old tax regime in the financial year 2022-23.

The amount available to apply for the standard deduction had to increase due to the high cost of working from home for employees due to the COVID-19 pandemic. The higher costs include higher internet connectivity, higher mobile / phone bills, mobile etc.

Above all,

A standard deduction of Rs 40,000 was introduced by 2018. In addition, the Union Budget in place of the Rs 19,200 transportation allowance and Rs 15,000 medical reimbursement to facilitate compliance and reduce employee documentation. It offers direct deduction from gross salary up to a maximum of Rs 50,000 and does not require the employer to submit an invoice to claim it. Starting in fiscal 2019-20, the standard deduction has been increased to Rs 50,000.

After that,

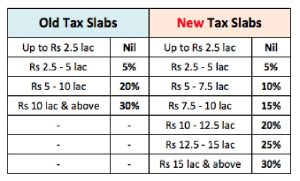

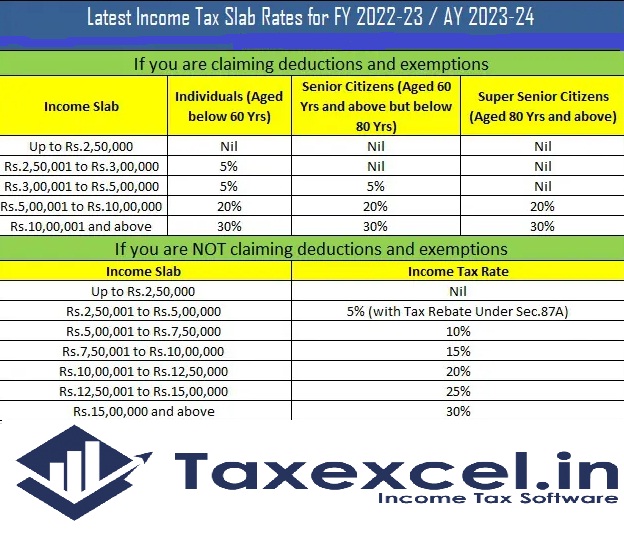

No change in income tax slab for the Financial Year 2022-23 and the Assessment year 2023-24

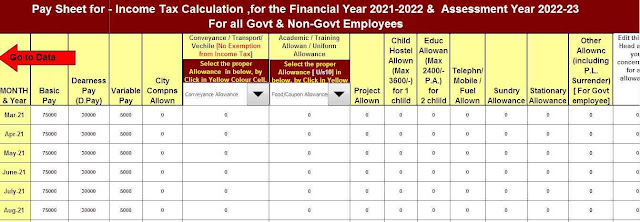

Download Automated Income Tax Preparation Excel Based Software All in One for the Government & Non-Government (Private) Employees for the F.Y.2021-22 and A.Y.2022-23

In conclusion,

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) Similarly, This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

Related posts:

- How to save tax | With Automated Income Tax Preparation Software in Excel for the Govt & Non-Govt Employees for the F.Y.2021-22 with Old and New Tax Regime.

- Highlights of Budget 2022 | With Automatic Income Tax Form 16 + Arrears Relief U/S 89(1) + Automatic Income Tax Preparation software All in One in Excel for the F.Y.2021-22

- NPS a good savings & Tax Benefits scheme | With Automatic Income Tax Preparation Software in Excel for the F.Y.2021-22 with Automated Income Tax Form 16 and Automated Arrears Relief Form 10 E

- Section 80DD Tax Exemption for the People with Disabilities as per Budget 2022 | With AutoFill Tax Form 16 for the F.Y.2021-22