PPF Investment | The public provident fund is one of these excellent schemes that you can consider as a long-term savings option. The special thing about this plan is that in addition to investing in it, you can invest as a Systematic Investment Plan (SIP).

By the way, there have been many new ways to save and invest these days. But even today much of the country deposits its money in post office schemes. At the same time, the post office also courts its customers with various schemes. Here you will get many types of savings options, investing in which you can get good returns. So let me tell you about the post office’s public pension fund scheme today.

What is the public pension fund?

Table of Contents

ToggleThe public retirement fund is one of these excellent schemes that you can consider as a long-term savings option. The special thing about this plan is that in addition to investing in it, you can invest as a SIP. In this scheme, you can deposit a maximum of Rs 1,5 lakh in one year.

You can get big returns on this plan

The interest on this scheme is higher than that of F.D or R.D, i.e. in this scheme, you can make big gains by depositing a small amount of money every month. There are no interest and income taxes at maturity.

How does the post office PPF calculator work?

Suppose you deposit 5,000 rupees each month into your PPF account, i.e. deposit 60,000 rupees for the whole year. Which is the compound interest rate of 7.1 will be charged. So, in such a situation, if you deposit for 15 years, your total investment will be 9 lakh rupees. At the same time, the maturity amount will be Rs 16.25 lakh and the interest amount will be Rs 7.25 lakh.

Find out what are the benefits of Post Office PPF

With this scheme, you can invest 1.5 lakh rupees in one year. you may also be given in 12 instalments. If you want, you can also open your children’s PPF account. Children under the age of 10 can also open a PPF account, which can be taken care of by the parents themselves. Not only that, if the scheme matures after 15 years, it is possible to extend it for 5 years. Based on this account, you can also take out a loan from the bank. You will not have to pay any taxes on this money.

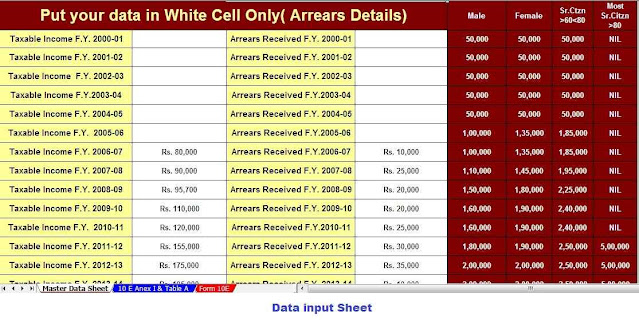

Download Automated Income Tax Arrears ReliefCalculator U/s 89(1) with Form 10 E from the Financial Year 2000-01 to Financial Year 2021-22(Up-to-date Version)

Related posts:

- Income Tax benefits from Medical Insurance U/s 80 D | With Automatic Income Tax Preparation Software in Excel for the Govt & Non-Govt Employees and Master of Form 16 Part B for the F.Y.2021-22

- Instant PAN through Aadhaar Card – How to apply for instant PAN?

- Deductions Income Tax Section 80 with Automated Income Tax Calculator All in One For the Govt and Non-Govt Employees for the F.Y.2022-23

- The standard deduction for employees | With Automated Income Tax Arrears Relief Calculator U/s 89(1) for the F.Y.2022-23 and A.Y.2023-24